Obama courts youth vote in North Carolina

(Credit:

Carolyn Kaster)

(Credit:

Carolyn Kaster)

UPDATED 2:55 p.m. ET

(CBS News) -- President Obama on Tuesday sought to reestablish his connections to the young people who helped him get elected four years ago, pushing for Congress to keep student loan rates low ahead of a planned rate hike in July.

In a speech to thousands of students at the University of North Carolina, Mr. Obama called on Congress to extend a 2007 law that now has student loan rates at 3.4 percent. If the subsidy were to expire as planned this summer, those rates would double to 6.8 percent.

Continue »House passes GOP tax cut bill

(Credit:

Chip Somodevilla/Getty Images)

(Credit:

Chip Somodevilla/Getty Images)

(CBS News) The Republican-led House on Thursday passed a bill aimed at spurring the economy by putting more cash in the pockets of small business owners.

Democrats, meanwhile, spurned the legislation as an ineffective measure that will put money in the hands of the wealthy -- not to mention controversial business owners like pornographers -- at the taxpayers' expense.

By a vote of 255 to 173, which fell largely along party lines, the House passed the Small Business Tax Cut Act. The measure would give small businesses with fewer than 500 employees a one-time 20 percent tax deduction.

When he unveiled the bill, House Majority Leader Eric Cantor said as many as 22 million small business owners could get the tax break "so that they can reinvest those funds." Today, he said it was "something we felt was the very least we could do to help the job generators."

The bill is sure to fail in the Senate, where Democrats have a similar but competing measure: The Senate bill would give small businesses tax breaks specifically for hiring new employees or for capital expenditures.

Continue »Poll: Economic outlook dim, but improving

(Credit:

CBS)

(Credit:

CBS)

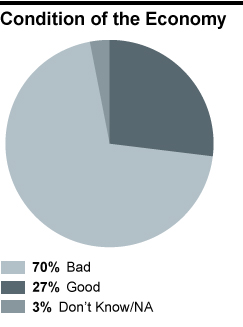

Americans are still largely down on the economy but have become slightly more optimistic, according to the latest CBS News/ New York Times poll.

And as President Obama and presumptive Republican nominee Mitt Romney lay out their competing economic visions, most Americans are confident either candidate could handle the economy. Voters are skeptical, however, that either candidate would help their own personal financial situation.

As many as seven in 10 Americans say the economy is in bad shape, according to the poll, conducted April 13-17. Another 27 percent think the economy is at in at least somewhat good shape - a low figure, but the best it's been since 2008.

The unemployment rate stood at 8.2 percent in March, and now, one third of Americans think the economy is headed in the right direction. Another 28 percent think the economy is getting worse, while 38 percent think it is staying the same.

Democrats are far more likely than Republicans to view both the condition and the direction of the economy favorably. Fifty-four percent of Democrats think the economy is getting better, and 42 percent think its condition is at least somewhat good. Only 16 percent of Republicans think the economy is getting better, and just 5 percent call the economy good.

Continue »ALEC backs down in wake of backlash

Updated at 3:30 p.m. ET

(CBS News) After coming under fire for pushing controversial laws like Florida's "stand your ground" law -- and losing multiple corporate allies -- an influential conservative legislative group announced on Tuesday it is limiting its scope to economic issues.

Indiana State Rep. David Frizzell, the 2012 National Chairman of the American Legislative Exchange Council (ALEC), said in a statement that ALEC is eliminating its Public Safety and Elections task force, which dealt with non-economic issues.

"While we recognize there are other critical, non-economic issues that are vitally important to millions of Americans, we believe we must concentrate on initiatives that spur competitiveness and innovation and put more Americans back to work," Frizzell said.

Continue »"Buffett Rule" fails in the Senate

(Credit:

photo courtesy flickr user John-Morgan)

(Credit:

photo courtesy flickr user John-Morgan)

Updated: 7:20 pm ET

The Senate on Monday struck down the so-called "Buffett Rule," a Democratic-backed measure that would require high income Americans to be taxed at a rate of at least 30 percent, with 51 Senators voting to proceed with a vote on the legislation and 45 voting not to proceed with a vote.

Democrats needed 60 votes to overcome a filibuster.

The vote was largely along party lines. Susan Collins, of Maine, was the sole Republican to vote for the rule, and Senator Mark Pryor, D-Ark., was the lone Democrat who voted against it.

As Americans across the country rush to file their taxes ahead of this year's April 17 deadline, Senate Democrats were pushing the Buffett Rule legislation, which would have mandated that income above $2 million would be taxed at least at a 30 percent rate, with a graduated boost in the minimum marginal rates for income between $1 million and $2 million.

President Obama has for months pushed a version of this legislation, which he argues would level the playing field for Americans who are unable to take advantage of the tax deductions and low rates on capital gains which benefit many high earners. White House officials have estimated that the Buffett Rule would produce $47 billion over ten years in additional tax revenue for the government.

Buffett rule: A Q&ACongress battles over tax changes as Tax Day nears Continue »

Congress battles over tax changes as Tax Day nears

(Credit:

iStockphoto)

(Credit:

iStockphoto)

This week, the Democratic-led Senate and the Republican-led House are voting on bills designed to serve as examples of their party's respective economic philosophies.

The Senate today votes on a version of President Obama's "Buffett Rule," which would require income above $2 million to be taxed at least at a 30 percent rate. The minimum tax rates for income between $1 million and $2 million would also increase at graduated levels. Republicans are likely to kill the bill, but Democrats see a potent message in the issue of economic fairness, particularly when the president's presumptive GOP opponent, Mitt Romney, has in recent years paid a relatively low tax rate on his personal fortune.

Continue »The Obamas paid 20.5% tax rate in 2011

(Credit:

CBS)

(Credit:

CBS)

Updated at 11:59 a.m. ET

The White House Friday morning released President Obama's and Vice President Joe Biden's 2011 tax returns, giving Mr. Obama's re-election campaign yet another opportunity to slam Republican rival Mitt Romney for only publicly releasing his tax returns as far back as 2010.

Mr. Obama and First Lady Obama filed their income tax returns jointly and reported adjusted gross income of $789,674. They paid $162,074 in taxes, at an effective rate of 20.5 percent. The first family also reported paying $31,941 in state income tax to Illinois.

The latest information comes amid Mr. Obama's campaign to enact the "Buffett rule" to ensure that the wealthiest Americans pay an overall tax rate comparable to middle class tax rates. The White House pointed out that under the tax policies endorsed by the president, like the expiration of the Bush-era tax cuts, Mr. Obama would pay more in taxes.

It's worth noting, however, that Mr. Obama wouldn't be hit by the version of Buffett rule, since he made less than $1 million last year. The current version of the legislation, which the Senate will take up next week, would mandate that income above $2 million would be taxed at least at a 30 percent rate, with a graduated boost in the minimum marginal rates for income between $1 million and $2 million.

Continue »Obama team attacks Romney on Lilly Ledbetter law

In this Jan. 22, 2009 file photo Lilly Ledbetter, an Alabama Goodyear Tire & Rubber Co. worker, speaks during a news conference on Capitol Hill in Washington.

(Credit: AP PHOTO)Updated at 2 p.m. ET

President Obama's re-election campaign on Wednesday showed its hand relating to Mitt Romney's weakness with women voters: Exploit it at every chance. When the Romney campaign did not immediately express support for a 2009 law making it easier for women to file lawsuits to combat discriminatory pay, the Obama campaign pounced.

Mr. Obama's team widely distributed out a statement from the law's namesake, Lilly Ledbetter, slamming the presumptive Republican nominee for the hesitation from one of his staffers.

"I was shocked and disappointed to hear that Mitt Romney is not willing to stand up for women and their families," she said. "If he is truly concerned about women in this economy, he wouldn't have to take time to 'think' about whether he supports the Lilly Ledbetter Fair Pay Act." The bill was the first piece of legislation Mr. Obama signed into law as president.

Continue »Buffett Rule: More politics than policy?

President Obama may be talking about policy today when he trumps the Buffett Rule in an official speech in Florida, but his re-election campaign is seizing the issue to hammer Mitt Romney, his presumed Republican opponent, on issues relating to his wealth and taxes.

The so-called "Buffett rule," which would compel wealthy Americans to pay at least a 30 percent tax rate, may have close to no chance of becoming law in this polarized environment. It does, however, give Mr. Obama the chance to espouse a broader philosophy of economic fairness. Republicans are also seizing on the political opportunities the Buffett rule presents, castigating the president for turning to "gimmicks" and "class warfare" to address serious problems like the deficit.

On Monday, the White House released an official report to illustrate the benefits of recalibrating the tax code. On Tuesday, Mr. Obama's re-election team blasted out a memo charging that Romney opposes the Buffett rule because "he thinks millionaires and billionaires should keep paying lower tax rates than middle-class families."

Continue »White House pushes Buffett rule on taxes

UPDATED 7:41 a.m ET

(CBS News) -- A new report today from the White House argues that making America's richest pay at least 30 percent tax rate, is more "a basic issue of tax fairness" than a way to generate lots of new revenue for a debt-ridden government.

On a campaign fund-raising trip today to Florida, President Obama will make the tax fairness argument as part of his latest pitch for the "Buffett Rule."

The proposal is due for a vote next week in the Senate, and Mr. Obama has made it a key element of his plan for deficit reduction.

Continue »